I’m finally getting around to overhauling the Discussion Forum Activity section of The Popularity of Data Analysis Software. To save you the trouble of reading all 43 pages, I’m posting just this section below.

Discussion Forum Activity

Another way to measure software popularity is to see how many people are helping one another use each package or language. While such data is readily available, it too has its problems. Menu-driven software like SPSS or workflow-driven software such as KNIME are quite easy to use and tend to generate fewer questions. Software controlled by programming requires the memorization of many commands and requiring more support. Even within languages, some are harder to use than others, generating more questions (see Why R is Hard to Learn).

Another problem with this type of data is that there are many places to ask questions and each has its own focus. Some are interested in a classical statistics perspective while others have a broad view of software as general-purpose programming languages. In recent years, companies have set up support sites within their main corporate web site, further splintering the places you can go to get help. Usage data for such sites is not readily available.

Another problem is that it’s not as easy to use logic to focus in on specific types of questions as it was with the data from job advertisements and scholarly articles discussed earlier. It’s also not easy to get the data across time to allow us to study trends. Finally, the things such sites measure include: software group members (a.k.a. followers), individual topics (a.k.a. questions or threads), and total comments across all topics (a.k.a. total posts). This makes combining counts across sites problematic.

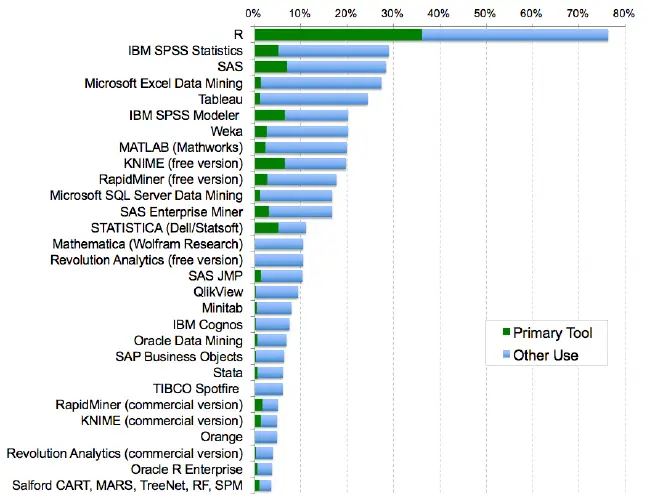

Two of the biggest sites used to discuss software are LinkedIn and Quora. They both display the number of people who follow each software topic, so combining their figures makes sense. However, since the sites lack any focus on analytics, I have not collected their data on general purpose languages like Java, MATLAB, Python or variants of C. The results of data collected on 10/17/2015 are shown here:

We see that R is the dominant software and that moving down through SAS, SPSS, and Stata results in a loss of roughly half the number of people in each step. Lavastorm follows Stata, but I find it odd that there was absolutely zero discussion of Lavastorm on Quora. The last bar that you can even see on this plot is the 62 people who follow Minitab. All the ones below that have tiny audiences of fewer than 10.

Next let’s examine two sites that focus only on statistical questions: Talk Stats and Cross Validated. They both report the number of questions (a.k.a. threads) for a given piece of software, allowing me to total their counts:

We see that R has a 4-to-1 lead over the next most popular package, SPSS. Stata comes in at 3rd place, followed by SAS. The fact that SAS is in fourth place here may be due to the fact that it is strong in data management and report writing, which are not the types of questions that these two sites focus on. Although MATLAB and Python are general purpose languages, I include them here because the questions on this site are within the realm of analytics. Note that I collected data on as many packages as were shown in the previous graph, but those not shown have a count of zero. Julia appears to have a count of zero due to the scale of the graph, but it actually had 5 questions on Cross Validated.

If you found this interesting, you can read about the results of other surveys and several other ways to measure software popularity here.

Is your organization still learning R? I’d be happy to stop by and help. I also have a workshop, R for SAS, SPSS and Stata Users, on DataCamp.com. If you found this post useful, I invite you to follow me on Twitter.