In my ongoing quest to track The Popularity of Data Science Software, I’ve updated the discussion of the annual report from Forrester, which I repeat here to save you from having to read through the entire document. If your organization is looking for training in the R language, you might consider my books, R for SAS and SPSS Users or R for Stata Users, or my on-site workshops.

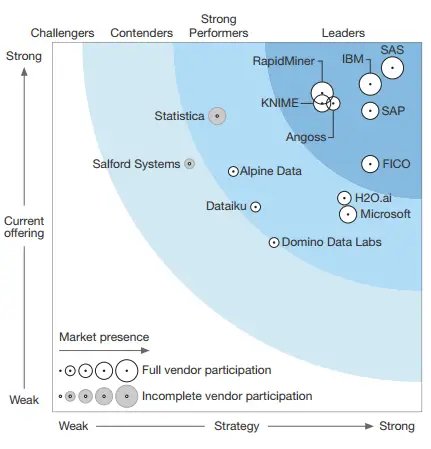

Forrester Research, Inc. is a company that provides reports which analyze the competitive position of tools for data science. The conclusions from their 2017 report, Forrester Wave: Predictive Analytics and Machine Learning Solutions, are summarized in Figure 3b. On the x-axis they list the strength of each company’s strategy, while the y-axis measures the strength of their current offering. The size and shading of the circles around each data point indicate the strength of each vendor in the marketplace (70% vendor size, 30% ISV and service partners).

As with Gartner 2017 report discussed above, IBM, SAS, KNIME, and RapidMiner are considered leaders. However, Forrester sees several more companies in this category: Angoss, FICO, and SAP. This is quite different from the Gartner analysis, which places Angoss and SAP in the middle of the pack, while FICO is considered a niche player.

In their Strong Performers category, they have H2O.ai, Microsoft, Statistica, Alpine Data, Dataiku, and, just barely, Domino Data Labs. Gartner rates Dataiku quite a bit higher, but they generally agree on the others. The exception is that Gartner dropped coverage of Alpine Data in 2017. Finally, Salford Systems is in the Contenders section. Salford was recently purchased by Minitab, a company that has never been rated by either Gartner or Forrester before as they focused on being a statistics package rather than expanding into machine learning or artificial intelligence tools as most other statistics packages have (another notable exception: Stata). It will be interesting to see how they’re covered in future reports.

Compared to last year’s Forrester report, KNIME shot up from barely being a Strong Performer into the Leader’s segment. RapidMiner and FICO moved from the middle of the Strong Performers segment to join the Leaders. The only other major move was a lateral one for Statistica, whose score on Strategy went down while its score on Current Offering went up (last year Statistica belonged to Dell, this year it’s part of Quest Software.)

The size of the “market presence” circle for RapidMiner indicates that Forrester views its position in the marketplace to be as strong as that of IBM and SAS. I find that perspective quite a stretch indeed!

Alteryx, Oracle, and Predixion were all dropped from this year’s Forrester report. They mention Alteryx and Oracle as having “capabilities embedded in other tools” implying that that is not the focus of this report. No mention was made of why Predixion was dropped, but considering that Gartner also dropped coverage of then in 2017, it doesn’t bode well for the company.

For a much more detailed analysis, see Thomas Dinsmore’s blog.

I’m surprised R and Python weren’t mentioned .

Hi Analytics Artist,

That’s because Forrester only evaluates products sold by companies. Most of the products the cover offer interfaces to both R and Python.

Cheers,

Bob